What is Variable Life Insurance?

Variable Life Insurance is considered permanent life insurance because your policy will be in force over your lifetime as long as your periodic premiums are paid. The three primary components of variable life insurance are:

- The policy death benefit (face amount)

- The cash value account in the policy

- The required periodic premium

Each time you submit a premium payment to your insurer, a portion of your payment is used to cover the actual cost of the life insurance and any fees that have been assessed. The remaining portion is deposited into your cash value account which is similar to a brokerage account.

The cash in your account can be invested in securities (using sub-accounts) which are similar to mutual funds. If your sub-accounts perform well, the earnings can remain in the cash value account and earn interest, used to purchase more death benefit, used as collateral for policy loans, taken as cash withdrawals. Additionally, if prefer to surrender your policy, you would receive all of the cash value in your policy minus any fees.

It’s important to note that if you use your cash value as collateral for policy loans, your account will continue to build cash value because the loan is from your insurance company and not a withdrawal from your policy’s cash account.

More about the Variable Life Insurance Cash Value Account

The cash value in a Variable Life Insurance policy works differently than the cash value of traditional whole life insurance or indexed universal life insurance. Your policy will come with a prospectus for all of the investment options that are available to you. These investment options are similar to a mutual fund because there is a defined list of securities that your sub-accounts would be invested in:

- Indexes such as the NASDAQ or S&P 500

- An equity portfolio

- Money market funds

- Bonds

What about the Management Fees associated with a Variable Universal Life Policy?

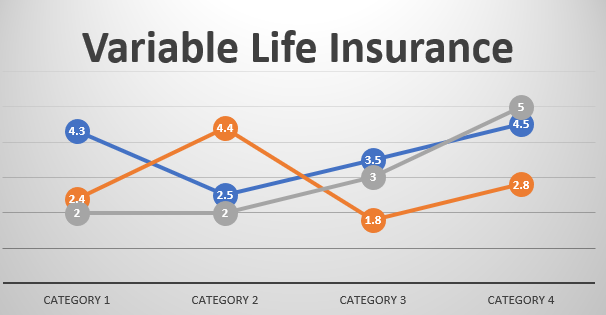

Every life insurance policy comes with some form of fees. Even inexpensive term life insurance has an annual policy fee that is included in your premium payment. Certainly, fees that are included with every cash-value life insurance policy are considered a downside and variable life insurance fees are typically the highest. The chart below provides a list of fees that are typically associated with every Variable Life Insurance policy:

| FEE | DESCRIPTION |

| Mortality expenses | Costs associated with the policy’s death benefit |

| Administrative fees and commissions | These costs include setting up and maintaining the policy as well as commission paid to the agent of record. |

| Investment Management | Fees based on the investment accounts you select |

| Surrender Charge | These are charges against your cash value account if you elect to surrender your policy and typically spread over the first 10 to 15 years |

| Loan Interest | When you take a loan against your policy’s cash value, the insurance company will charge interest on your loan. |

| Withdrawal Fees | Every withdrawal you take from your cash value account triggers a small transaction fee. |

| Policy Riders | Riders are optional coverages that you can add to your policy typically result in an additional premium. |

Since Variable Life Insurance policies are regulated by the Securities Exchange Commission, the fees are typically higher than traditional life insurance policies and should be a part of your consideration to purchase.

How is Death Benefit Calculated on a Variable Universal Life Policy?

The death benefit in your variable universal life policy is generally set up in two separate methods. You can choose a level death benefit which is equal to the policy’s face value at the time of purchase, or you can choose the face amount of the policy plus the available cash value at the time of your death. The death benefit plus cash value choice will cost a little more but your beneficiaries will receive a higher death benefit.

Although these are the most common choices for a death benefit, different insurance carriers provide different options so make sure you find out what is available to you and will offer you the better solutions for your circumstances.

What are the Advantages of Variable Universal Life Insurance?

Certainly, every insurance product has advantages and disadvantages depending on your circumstances and your budget and your choice should be based on whether a particular type of policy will deliver the solution to your needs.

- Variable Universal Life Insurance provides coverage for a lifetime. Once your variable life policy is issued, the insurance company cannot cancel your coverage for any reason other than non-payment.

- Tax-deferred earnings: A variable life policyholder need not be concerned about taxes on the policy’s growth and your beneficiary need not be concerned about taxes on the death benefit.

- Higher earnings than traditional whole life insurance. Even though traditional whole life insurance is guaranteed to earn a minimum interest rate, the potential growth in a variable life insurance policy is typically higher.

What are the Disadvantages of Variable Universal Life Insurance?

The disadvantage of any life insurance policy does not mean there is something wrong with the product, it just means that the product is not the best solution for your individual needs.

- Variable Universal Life Insurance costs a lot more than term insurance. Since the premiums for variable life insurance include additional money for the cash value account, you are paying more than just the cost of life insurance and therefore these policies will always cost more than inexpensive term life insurance.

- Premiums are not guaranteed to be level. If the investment component in your variable life insurance policy does not perform well, your insurer can increase your periodic premiums to make sure your policy remains in force.

- Higher management fees. Your insurance company will charge fees on each of the management accounts in your policy just as a mutual fund does but the fees on your policy’s sub-accounts will generally be higher.

The Bottom Line for Variable Universal Life Insurance

Variable Universal Life Insurance is not for everybody. In fact, most insurance and financial professionals will steer you away from buying it. If, however, you feel like you are smart, informed, and careful investor and the fees are not a deal breaker, variable life insurance can be an excellent choice for consumers who want permanent life insurance and the opportunity accumulate significantly more cash value than traditional whole life insurance.