Life Insurance Definition

Life insurance definition can be explained as many things, such as peace of mind or a security blanket for loved ones. But, the legal life insurance definition is a contract between you and the insurer, in which the insurer guarantees a tax-free lump sum of cash to your beneficiaries in exchange for a premium.

What is Life Insurance Used For?

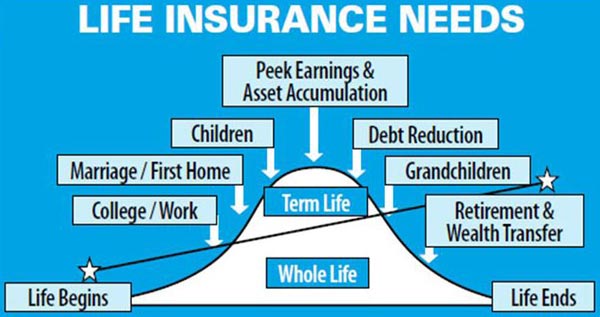

Life insurance’s general purpose is to provide financial security to loved ones in the event of your death. It’s used to cover expenses ranging from funeral costs, mortgage payoff, or income replacement.

It’s important to always analyze your current financial situation when trying to calculate what amount of life insurance is needed to protect your loved ones. Life insurance brokers will be key in helping you assess your needs and recommending the type of life insurance that fits you and your life.

NOTE: Check out our needs analysis tools

It’s always a good idea to review your life insurance policies and needs annually or after major life events such as, getting married, getting divorced, having a baby, or major purchases, like a home.

Types of Life Insurance

You will have several different types of life insurance to choose from which can get confusing. This is why an experienced life insurance agent will prove resourceful. The types of life insurance to choose from are:

Whole Life Insurance

- Non-Participating Whole Life Insurance

- Participating Whole Life Insurance

- Final Expense/ Burial Insurance

- Graded Benefit Whole Life Insurance

- Guaranteed Issue Whole Life Insurance

Term Life Insurance

- Level Term Life Insurance

- Decreasing Term Life Insurance

- Annual Renewable Term Life Insurance

Universal Life

- Traditional Universal Life

- Guaranteed Universal Life

- Indexed Universal Life

- Variable Universal Life

Top Life Insurance Companies for 2019

The Definition of Life Insurance Policies

A life insurance policy has 3 major components. They are:

Death Benefit: This is the amount of money that is paid out to the insured’s beneficiaries upon his/her death. The insured chooses the death benefit amount that best fits their financial obligations.

Premium: The premium is the amount charged to the insured for the death benefit chosen. They are based on actuary and mortality tables. The premium is also referred to as the sum of cost of insurance, administrative fees, and maintenance fees. Factors that affect the cost of insurance are the insureds age, health situation, occupational hazards, and high risk hobbies.

As long as you pay the premium the insurance company is obligated to pay the death benefit. The premium amount for a term policy is based on what the cost of insurance is for the insured, while for permanent policies (whole or universal life) the premium includes the cost of insurance on addition to the cash value amount.

Cash Value: The final component to a life insurance policy only has to do with permanent policies such as whole and universal life insurance. The cash value component comes in handy for different life occurances.

It’s a savings account, that can be used when needs arise, while the primary purpose is to offset cost of insurance which increases in some universal life policies over time. Cash values grow tax deferred and can be withdrawn tax-free if done correctly.

What is the Life Insurance Definition on Riders?

Riders or add-ons are offered to policyholders who wish to customize their policies. They allow consumers to accommodate other personal needs without having to take out a separate insurance policy.

While riders are common with most insurance policies, the availability depends on which insurance company you choose. The most common riders are:

Accidental Death Benefit Rider: This rider provides extra life insurance coverage if death is by an accident.

Waiver of Premium Rider: This add-on will pay the premiums of your life insurance policy if you were to become disabled. Premiums are paid by the company for the duration of your disability.

Disability Income Rider: If you become disabled, this rider will pay a monthly income, usually for 2 years, if you become disabled and are unable to work.

Accelerated Death Benefit Rider (ADB): The ADB rider allows you to access a percentage of the death benefit if you have been diagnosed as terminally ill, meaning you have been giving only a year or less to live. This rider is usually add to all policies at no extra cost to the consumer.

Living Benefits Rider: This rider allows access to a percentage of the death benefit early if you were to be diagnosed with a major illness such as heart attack, stroke, cancer, etc. The more serious the illness, the higher percentage of the death benefit that can accessed.

Spousal Term Rider: This allows for a term life insurance rider for your spouse to be added to your policy. This allows coverage for both husband and wife on one policy.

Return of Premium Rider (ROP): The ROP rider is added to term life insurance policy, and guarantees all premiums are returned at the end of the term period if the insured is still alive.

If the ROP rider is added to a permanent policy, then your beneficiaries will not only receive the death benefit but also all premium paid into the policy at the insured’s time of death.

Every policy sold is unique to you and the life insurance company. Reviewing your documents is a necessity in order to understand the coverage’s offered and if any additional riders are needed.

Get an Instant Life Insurance Quote Here

Final Thoughts

We hope you enjoyed reading about the life insurance definition, how a policy is designed, and what it covers and does not cover. We hope this helps with your journey purchasing life insurance. If you have any questions or need a quotes please don’t hesitate to let us know.

Frequently Asked Questions

What is the definition of life insurance?

The definition of life insurance can be explained as many things, such as peace of mind or a security blanket for loved ones. But, the legal life insurance definition is a contract between you and the insurer, in which the insurer guarantees a tax-free lump sum of cash to your beneficiaries in exchange for a premium.

What are riders added to a life insurance policy?

Riders or add-ons are offered to policyholders who wish to customize their policies. They allow consumers to accommodate other personal needs without having to take out a separate insurance policy. While riders are common with most insurance policies, the availability depends on which insurance company you choose.

What is life insurance used for?

Life insurance’s general purpose is to provide financial security to loved ones in the event of your death. It’s used to cover expenses ranging from funeral costs, mortgage payoff, or income replacement.

What are the types of life insurance offered?

The types of life insurance offered are term life, whole life, and universal life insurance. Term life insurance only lasts a certain number of years while whole and universal life are permanent policies that last the life of the insured.