Best Life Insurance for Physicians

Depending on your situation, it could also be used for paying off loans or mortgages, college or education debt, or to replace the deceased’s income for surviving family members.

Often, these types of policies are utilized for business purposes such as paying overhead expenses for a medical office upon the unexpected passing of a KEY physician or employee.

Life Insurance Coverage Types

While there is a ton of various life insurance products out there, there is basically two types of coverage: term life and permanent life.

Term life insurance is the most simple and easiest to understand and is almost always the cheapest in price. Term coverage only protects the insured for a certain period of time, usually ranging from 10-30 years depending on some key factors such as your age or health.

Permanent life insurance is more complex and has higher premiums compared to term, but it offers more benefits and covers a longer period, usually forever. Whole life is the most commonly recognized type of permanent insurance. Other kinds include universal life, indexed universal life and variable life insurance.

What is Better: Term Life or Permanent Life Insurance?

Choose Term Life Insurance if:

- You need life insurance only to replace your income over a certain period such as a mortgage time frame or during years of child rearing.

- You want the most inexpensive coverage.

- You think you might want permanent life insurance but can’t afford it.

- Most term life policies are convertible to permanent coverage. The deadline for conversion varies by policy.

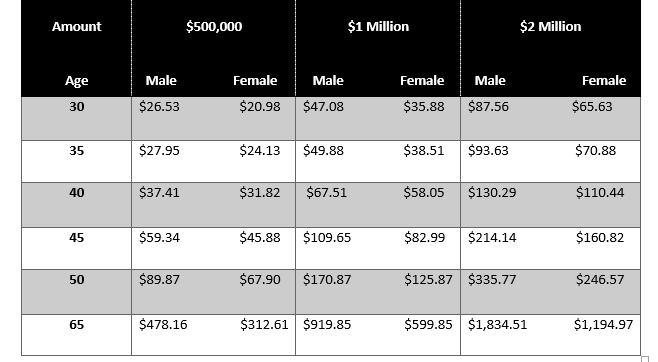

Term Life Insurance for Physicians Sample Rates

Preferred Non-Tobacco/20 Year Term/Monthly Rates

Choose Permanent Life Insurance if:

- You want to provide money for your heirs to pay estate taxes. Not having a life insurance payout, may force your heirs into having to sell off parts of the estate, such as heirlooms or property, to pay the tax bill.

- You have a lifelong dependent, such as a child with special needs or a disability. Life insurance can fund a trust to provide care for your dependent after you’re gone.

- You want to spend your retirement savings while still leaving an inheritance or final expense money for your loved ones. Having a permanent life policy would guarantee your beneficiaries get a payout no matter when you die.

- You want to equalize inheritances. If you plan to leave a business or other property to one child, permanent life insurance policy could be used to compensate your other kids.

Permanent Life Insurance for Physicians Sample Rates

Preferred Non-Tobacco, Guaranteed Universal Life, Monthly Premiums

Physicians Can Invest and Protect for Less

More times than not, term life insurance coverage is best for most high income yielding medical professionals and physicians. The initial low premium aspect coupled with a set time frame makes term life insurance a good fit for most physicians’ and medical professionals’ life insurance coverage needs. Here’s a few reasons why:

Higher Amounts of Coverage

Because the premiums for term life insurance are typically so inexpensive, policyholders are able to purchase higher amounts of coverage – and this can be a real benefit for physicians. Typically for those just starting residency, the likelihood of your income increasing over time is highly probable. Thus, your income replacement needs going forward are also going to increase. With this in mind, your income replacement and protection needs are going to be greater and more complex.

Even though there is no cash value or investment component offered with term life insurance, the death benefit proceeds from these plans could be directed as desired just like any other types of life insurance. Therefore, funds can be allocated for income replacement, mortgage and property payoff, and many other business or personal expenses.

Leaves More Discretionary Funds to Invest

Term life insurance is known for being the cheapest coverage. Having this coverage will allow you to protect what’s important to you while being able to direct a higher percentage of your other discretionary income towards saving and investments.

By going this route, you have a couple of advantages. First, you will be able to build up your savings and retirement fund at a very fast pace. Secondly, by choosing a term life policy over a comparable amount of permanent life insurance coverage, you will save a tremendous amount of premium.

The point here is to be disciplined in diverting a certain amount of funds towards building your savings and investments. As these funds accrue, it could even become possible to self-insure in the future.

Even though permanent life insurance can build up considerable amount of cash value over time, life insurance should never be purchased just for the purpose of savings or investments. Reason being is that a large percentage of the premium on most policies will be going towards paying the death benefit coverage as well as other policy expenses.

Term Life Insurance for Physicians

As you continue your wealth building journey it is likely that at some point, you will no longer need the protection of the life insurance proceeds because of your ability to self-insure your debt and income replacement needs. Until you have reached self- insurability status, term life insurance allows a way to very inexpensively provide the protection that you currently need.

The Bottom Line on the Right Type of Life Insurance for Physicians

The saying “buy term and invest the difference” couldn’t be more fitting for medical professionals and physicians. If it is properly implemented, this strategy can allow you to accumulate a great deal of wealth while simultaneously protecting assets for practically pennies on the dollar. This technique can also provide you the opportunity to eventually eliminate your term life insurance when the time is appropriate. As a result you will no longer have to make a premium payment.

When purchasing life insurance, it is crucial to know the difference in plans offered as well as how they perform, because buying the wrong type of coverage has the potential to affect your financial future. If you have any questions or would like some more information, please give us a call.